GSTR-9 & GSTR-9C Manual for FY 2024-25

GSTR-9 & GSTR-9C Manual for FY 2024-25

GSTR-9 & GSTR-9C Manual for FY 2024-25

GSTR-9 & GSTR-9C Manual for FY 2024-25 (Table-wise with Updated CBIC Instructions)

As the due date for filing GSTR-9 and GSTR-9C for FY 2024-25 is approaching, professionals have already begun working proactively to ensure timely completion and compliance.

Like every year, we have released the comprehensive GSTR-9 & GSTR-9C Manual for FY 2024-25, prepared exclusively for professionals and followers to simplify filing and reconciliation.

This updated manual includes:

Table-wise breakup with mandatory, optional, and auto-fill details

Latest CBIC instructions and portal-related updates

Practical guidance for accurate and error-free filing

Access the manual through the link below:

Click below to download Table wise GSTR-9 manual for FY 2024-25

https://drive.google.com/file/d/1YA5IO0wW4lNmz7hFI5UMcw1tKqkEvJaC/view?usp=sharing

Click the below link to download Table wise GSTR-9C manual for FY 2024-25

https://drive.google.com/file/d/12G48_ieHDqygDKcVTVSl_4ekFixq7cpc/view?usp=sharing

Click the below link to download FAQ by GSTN on GSTR-9 & GSTR-9C

https://drive.google.com/file/d/1luwOPY-I-zFQGtGBgN7xmb5l-OZq5Cny/view?usp=sharing

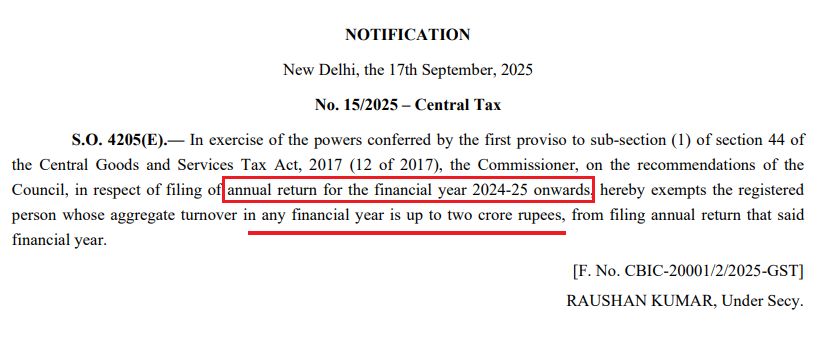

Who is required to file GSTR-9 (Annual Return)?

Taxpayers having aggregate turnover upto Rs.2 Crores are exempted from filing GSTR-9 from FY 2024-25 onwards vide Notification No.15/2025 - CT. All other taxpayers are required to file GSTR-9 for FY 2024-25.

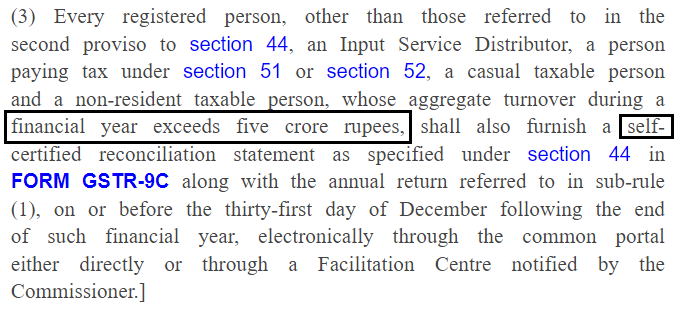

Who is required to file GSTR-9C?

Taxpayers having aggregate turnover upto Rs.5 Crores are exempted from filing GSTR-9C for FY 2024-25 vide Rule 80(3) of CGST Rules. All other taxpayers are required to file GSTR-9C for FY 2024-25.

What is Aggregate Turnover?

“Aggregate Turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess;

What is Due date for filing GSTR-9 & GSTR-9C for FY 2024-25?

Due date for filing GSTR-9 & GSTR-9C for FY 2024-25 is 31st Dec 2025.

Prepared & Presented by:

Dr. Muhammed Mustafa C T

Senior Tax Consultant, BRQ Associates

???? +91 96331 81898

???? brqassociates@gmail.com

???? www.brqassociates.com

DISCLAIMER:-

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any query or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact at 9633181898 or via WhatsApp at 9633181898.

Featured Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

Latest Posts

- Restoration of GST Registration Allowed Subject to Filing of Returns and Payment of Dues -Jammu & Kashmir High Court

- റിട്ടേണുകൾ സമർപ്പിക്കുകയും കുടിശ്ശികകൾ അടയ്ക്കുകയും ചെയ്യുന്നുവെന്ന നിബന്ധനയ്ക്ക് വിധേയമായി ജിഎസ്ടി രജിസ്ട്രേഷൻ പുനഃസ്ഥാപിക്കാൻ ജമ്മു & കാശ്മീർ ഹൈക്കോടതി അനുമതി നൽകി.

- Allahabad High Court Quashes GST Demand Over Procedural Lapses: Wrong GSTIN, Demand Beyond SCN & Improper Service.

- തെറ്റായ GSTIN, അറിയിക്കാത്ത അധിക ഡിമാൻഡ്, നോട്ടീസ് ലഭിക്കാത്തത് – ഗുരുതര പിഴവുകൾ ചൂണ്ടിക്കാട്ടി GST ഉത്തരവ് അലഹാബാദ് ഹൈക്കോടതി റദ്ദാക്കി.

- No More Silent Auditor Changes — ICAI Releases Updated UDIN Portal Manual with Strong New Mandates.

Popular Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

BRQ GLOB TECH

BRQ GLOB TECH